If you’re into budgeting and saving, I’m sure you’ve heard about the Mint app by now. The Mint app allows you to set budgets for a wide variety of categories for each month. It’s linked to your bank accounts so you get a real-time view of what you’re spending and your income. This makes tracking whether you’re going over or under a budget mindlessly simple.

If you are big on saving, I don’t know why you wouldn’t want this app. If you have a specific goal Mint helps you see whether or not you’re on track. You can make informed decisions on whether or not you can truly afford that vacation or new outfit you’ve been wanting.

My husband and I recently bought a condo in Toronto and have been loving it so far. We want to start a family in the near future, so we may need to upgrade to something a little bigger in a few years. My goal is to have a down payment that will allow us to do that in the next 3 years. Since we already own a property, we need to have at least 20% of the down payment for our next home.

My goal is to save at least $50,000 in 3 years. If I save $1400 every month, I should be able to do that.

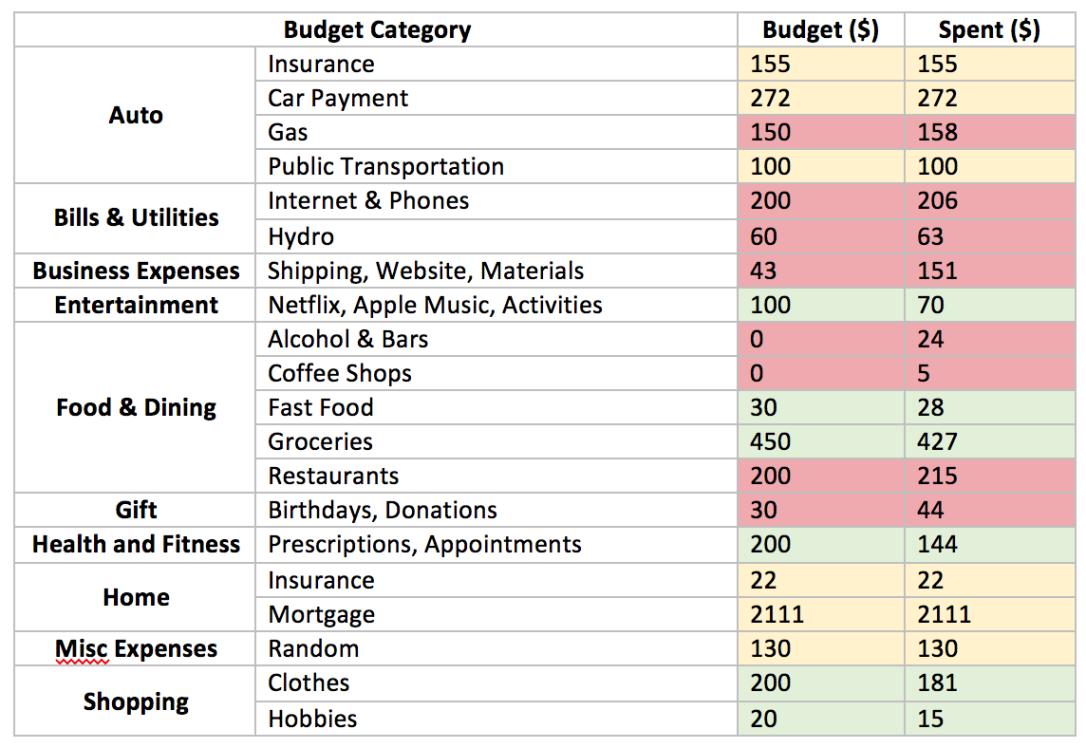

January Financial Round-Up

Expenses: $4661

Income: $6100

Savings: $1439

January Budget Review

Notes

Where we met the budget:

- These expenses are fixed and should be the same month-to-month.

Where we came under budget:

- Entertainment: We had a birthday this month where the activity was bubble soccer (SO much fun!). The activity itself cost less than what we thought it would.

- Fast Food: We’ve been able to stay under budget by choosing simply to make meals at home.

- Groceries: We tried this “vegetarian challenge” where we vowed not to buy meat for a week after it ran out. I think this has saved us a lot of money.

- Prescriptions: My husband is a type 1 diabetic so we regularly need to restock his supplies. This month wasn’t as much as we’d anticipated.

- Clothes: I’m a bridesmaid for my best friend and needed a dress. I’m happy to say we were able to find a great one under budget and quickly!

- Hobbies: I didn’t spend as much on hobbies this much as expected.

Where we went over budget:

- Gas: This category is harder to predict exactly… but it’s usually more or less around the $150 mark.

- Internet & Phones: Our current plans charge long distance if we call numbers outside of Toronto. We made a few calls.

- Hydro: We pay the city every 2 months so this is 2 months-worth of hydro.

- Business Expenses: We’d unexpectedly run out of ink. As we mainly use the printer for our business, I put the ink charge under business and we went way over.

- Restaurants: We made a few impulsive restaurant choices which caused us to go a bit over.

- Birthdays: Our gift went slightly over budget.

Budget Goals for February

- Save $1400

- Eat out less in restaurants

- Continue the Vegetarian Challenge and come even more under budget

- Don’t buy any clothes

Final Thoughts

We did pretty good for January. I can’t wait to see if we’re able to save even more in February. Thanks to the Mint app, we’ll be aware of where we stand budget-wise.

I’ll post our February budget in a few days. Are you also tracking expenses for 2018? What were your big wins?

That is an awesome post, I dabble in budgeting and it’s the best! Can’t wait to see your forecast for February 🙂

LikeLike

Thanks so much! Budget for Feb is in the works and I’ll definitely need to be creative and resourceful to meet the savings goal!

LikeLiked by 1 person

Awesome, I will follow to keep track on the journey, best of luck 🙂

LikeLike

I have heard about this app and would love to have it too but too bad its not available in my country. Thanks for the share.

LikeLike

I love the Mint app! It helps keep me on track so much! I’d be lost without it! Great article

LikeLike

Love this! I love budgeting and this is super clear 🙂

https://sophieschoice.co.uk

LikeLike

Great post and I love your blog…

LikeLike

Thanks so much! ☺️

LikeLiked by 1 person